Value-Added Tax (VAT) on Digital Services Law (Republic Act No. 12023)

Republic Act No. 12023, also known as the Value-Added Tax (VAT) on Digital Services Law, is a law implemented in June 2025 that subjects a 12% tax on digital products and services by foreign providers. This includes digital games, microtransactions, and subscriptions from platforms like Steam and Nintendo eShop.

About

Signed into law

On October 2, 2024, President Ferdinand "Bongbong" Marcos Jr. signed Republic Act No. 12023, or the Value-Added Tax (VAT) on Digital Services Law. The law imposes a 12% VAT on foreign digital service providers such as Steam.[1] At that time, only domestic digital service providers were subject to paying the VAT.

Implementation

Overview

Foreign digital service providers were required to register with the Philippines' Bureau of Internal Revenue by June 1, 2025. Their services would become subject to 12% VAT starting June 2, 2025.

Steam

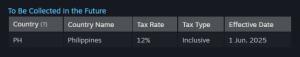

On March 17, 2025, Steam's "Taxes FAQ" documentation was updated to include the Philippines. Under the section "To Be Collected in the Future", Steam digital products purchased in the Philippines will have a 12% inclusive tax rate effective June 1, 2025.[note 1]

Contrary to the rumors spread on social media, there was no immediate price increase for game purchases upon implementation, nor is Steam "absorbing" the VAT post-implementation. Steam's VAT rates are inclusive and have been the same system for other countries for years. The platform automatically deducts VAT from the regional prices set by publishers (the sellers), rather than adding it. VAT is deducted from the publishers' net revenues before any revenue sharing with Steam,[note 2] It is the responsibility of the publishers to determine and update their regional prices based on individual countries' tax rates to reduce losses.

While there was no immediate increase,[note 3] the tax could influence future price increases of newer games, especially for self-published indie games.

Google services including Google Play

On June 2, 2025, Google began adding a 12% exclusive tax to its products and services, including in-app purchases from third-party games in Google Play. An advertised ₱100 microtransaction, for example, is charged as ₱112 upon checkout.

PlayStation Store

At the time of tax implementation, the Philippines was not supported on the PlayStation Network, the service where the PlayStation Store is located. Players in the Philippines purchase digital goods by setting their accounts under a different country.

Nintendo eShop

At the time of tax implementation, the Nintendo eShop was not yet launched in the Philippines.

Notes

- The added tax requirement started on June 2, Philippine time. The June 1 deadline by Steam could be in U.S. time.

- As stated under the "VAT and Sales Tax" of the Taxes FAQ Steamworks Documentation: "[Steam pays] based on Net Revenues which is Gross Revenues less Applicable Adjustments. Gross Revenues includes VAT and sales tax, if applicable. Applicable Adjustments include taxes, returns and chargebacks." The final pay is the Net Revenues multiplied by the revenue share percent between Steam and the publisher.

- An increase requires a publisher to manually update their prices for a single country with a potentially small market. As there were no price increases at the time of implementation, publishers simply did not prioritize the issue and are willing to shoulder the losses for their current games for the time being.

Reference

- Marcos signs into law VAT on foreign digital services. October 2, 2024 at 9:15 AM, updated 1:33 PM. Anna Felicia Bajo, GMA Integrated News. GMA News Online. Retrieved on 2025-03-18.