Steam's Philippine value-added tax price increase

On June 1, 2025, the Steam platform would start implementing a 12% tax rate inclusion on its digital products and services, thereby increasing the prices of games and microtransactions.

Background

On October 2, 2024, President Ferdinand "Bongbong" Marcos Jr. signed Republic Act No. 12023, or the Value-Added Tax (VAT) on Digital Services Law. The law imposes a 12% VAT on foreign digital service providers such as Steam.[1] At that time, only domestic digital service providers were subject to paying the VAT.

About

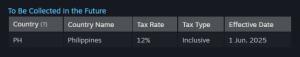

On March 17, 2025, Steam's "Taxes FAQ" documentation was updated to include the Philippines. Under the section "To Be Collected in the Future", Steam digital products purchased in the Philippines would have a 12% inclusive tax rate effective June 1, 2025.

Reference

- Marcos signs into law VAT on foreign digital services. October 2, 2024 at 9:15 AM, updated 1:33 PM. Anna Felicia Bajo, GMA Integrated News. GMA News Online. Retrieved on 2025-03-18.